The Perfect Plate – 2025 Q2 and August Update

Every month, we’ll provide updates on the latest trends in the restaurant industry. We’ll include financial insights, charts, and public market comps.

Key Takeaway | Perceived Value as the Defining Factor

Overview:

The first half of 2025 continued to spotlight the power of perceived value in the restaurant industry. With people saving more and spending carefully because of inflation and high borrowing costs, restaurants offered clear value, both in price and experience did well. Those that didn’t meet what customers expected saw fewer visitors and lower sales.

Perhaps the key brand that displays this trend the most is Sweetgreen, where the price of the salad bowl is starting to measure up to the consumer’s expectations – they have made corrections to increase portion sizes in an effort to improve guest traffic.

2025 Q2 Earnings Report Summary

| Company | Same Store Sales | Executive Focus |

| Chili's Grill & Bar | 23.7% | Value meals, traffic surge |

| Dutch Bros | 7.8% | Loyalty app, new drinks |

| Texas Roadhouse | 5.8% | Pricing power, strong demand |

| Applebee's | 4.9% | Promotions, value recovery |

| Cracker Barrel | 4.7% | Menu updates, traffic lift |

| Taco Bell | 4.0% | Menu innovation, value promotions |

| Sweetgreen | (7.6%) | Operational reset, guest experience focus |

| Bonefish Grill | (5.8%) | Weak traffic, value gaps |

| KFC | (5.0%) | Competition, weak promos |

| Pizza Hut | (5.0%) | Value messaging struggles |

| Jack in the Box | (4.4%) | Traffic declines |

| The ONE Group (STK) | (4.9%) | Transaction growth offset by sales decline |

We found this article from Restaurant Dive very insightful, and we’re seeing the same trend among our clients who deliver strong value for their menu price points. The piece highlights that in the first half of 2025, customer perception of value has become the biggest factor in whether they choose to dine out.

H1 2025 Winners: Value-First Operators

- Chili’s was the standout, achieving a 23% same-store sales gain, fueled by value-driven promotions, operational investments (e.g., TurboChef ovens), and traffic growth.

- Taco Bell (+4%) leveraged an aggressive value strategy, menu innovation, and loyalty program growth to sustain momentum.

- Potbelly (+3%) benefitted from positive traffic trends and new unit expansion, outperforming the fast-casual segment.

- McDonalds (U.S.) (+2.5%) stabilized growth through menu innovation, value platforms, and loyalty programs.

- Applebee’s, Dominos, Papa Johns, Burger King, and Olive Garden also delivered positive results by combining pricing alignment, operational improvements, and menu or loyalty enhancements.

H1 2025 Losers: Value Perception Challenges

- Sweetgreen (-7.6%) saw declining traffic as customers questioned the value vs. price of its offerings.

- Chipotle (-4%) faced weaker transactions despite higher average checks, highlighting gaps in perceived value.

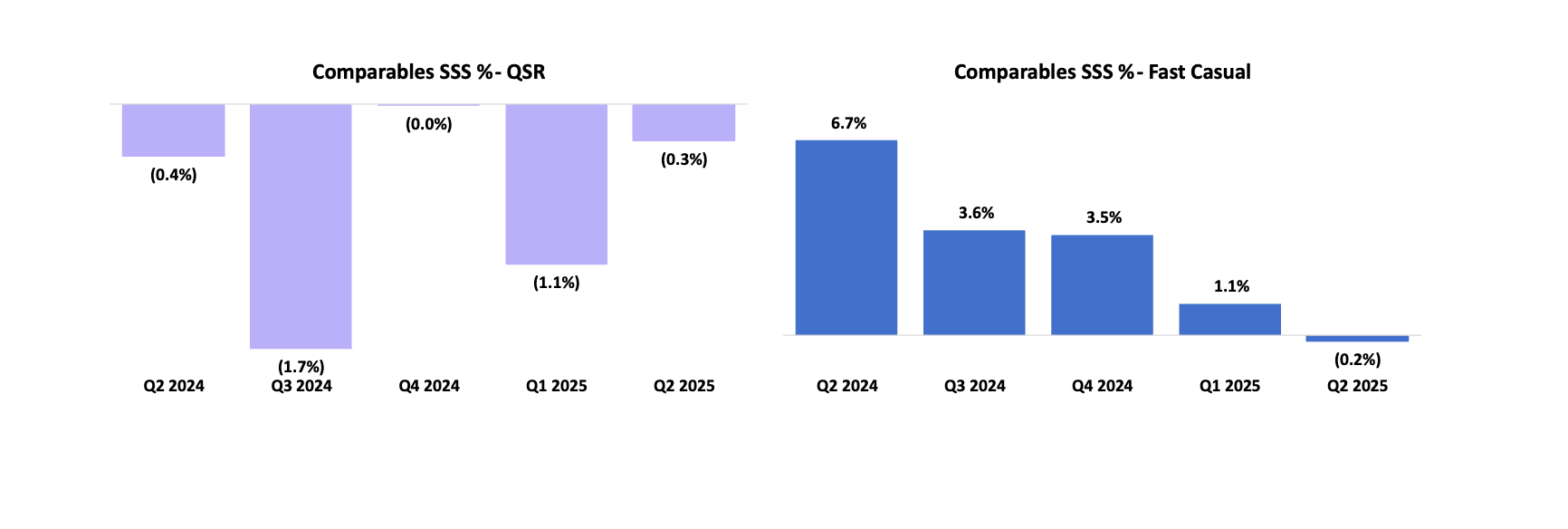

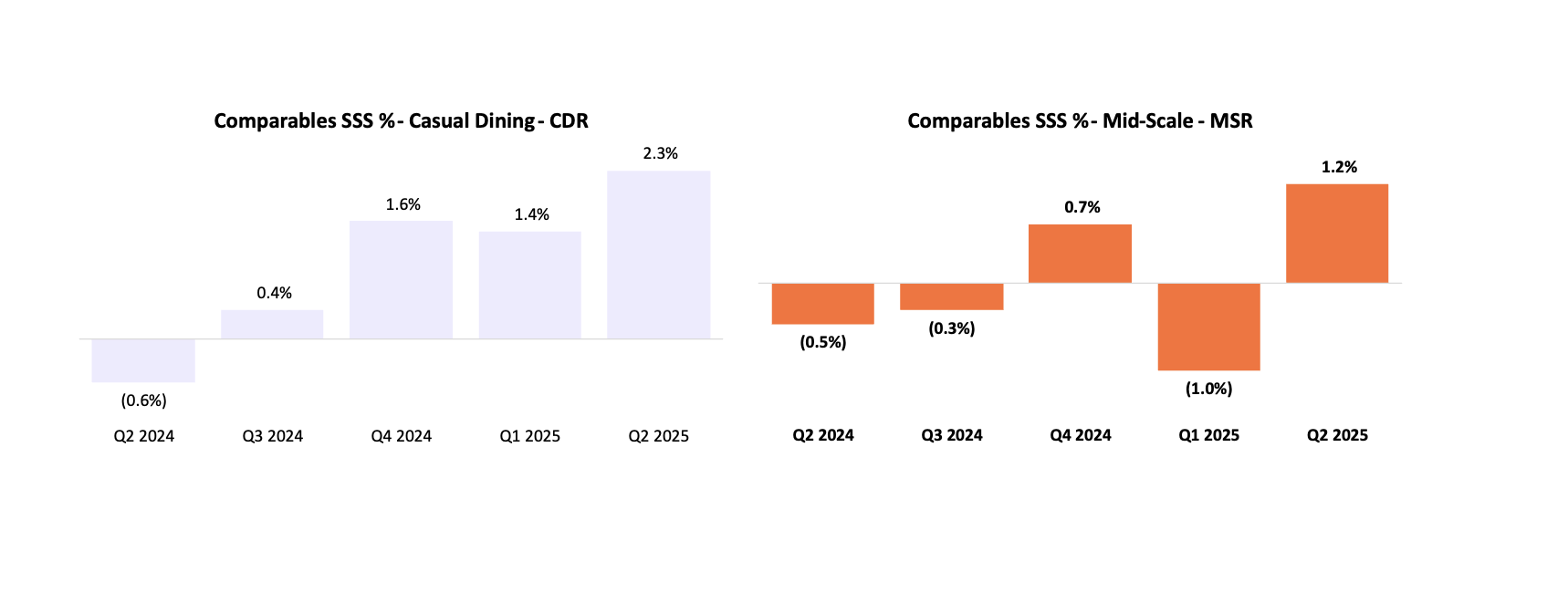

Trailing 5-Quarter SSS % Performance by Category Segment

2025 has seen stronger sales performance for Full Service and Fine Dining concepts compared to QSR and Fast Casual.

Consumers have shown some spending fatigue for the ‘bowl concepts’ and have generally opted to allocate more spend to the restaurant experience which is only at a slightly higher price point.

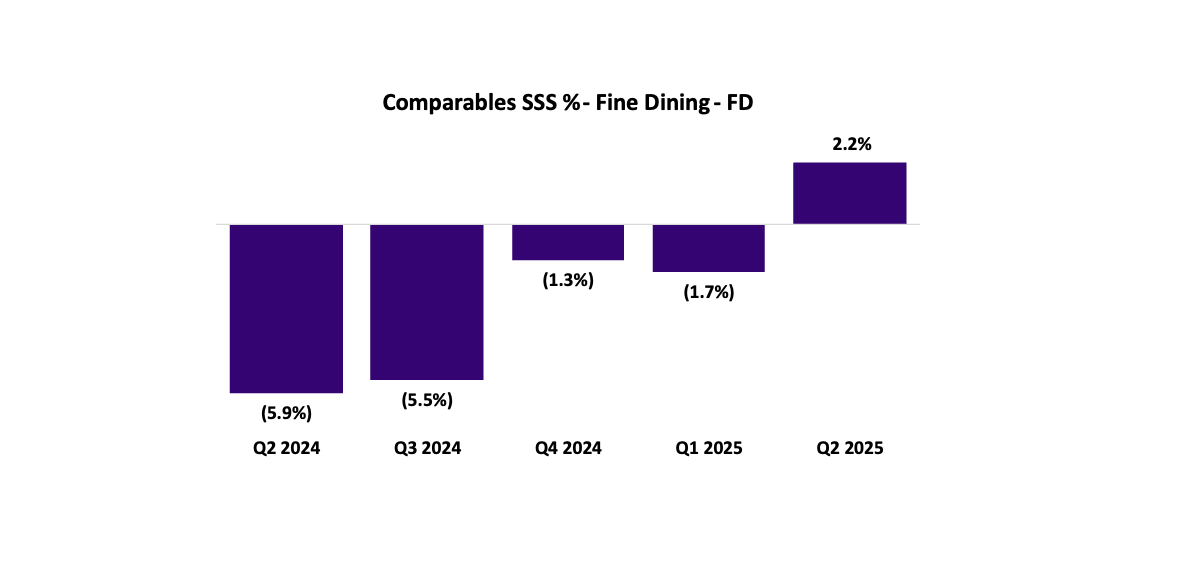

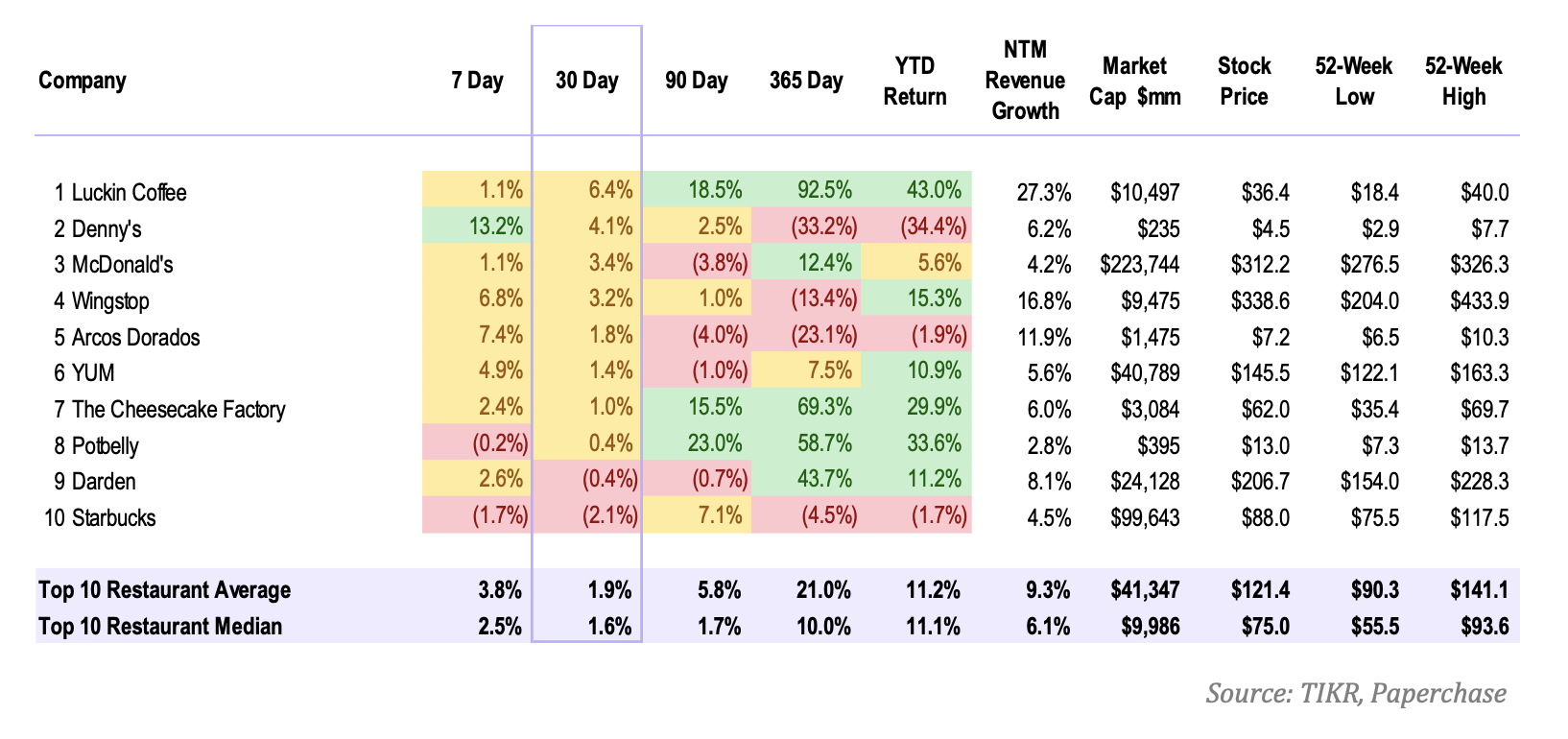

Public Market Top 10 for the Week

Denny’s leads the top 10 for the week ending Friday, 15 August 2025.

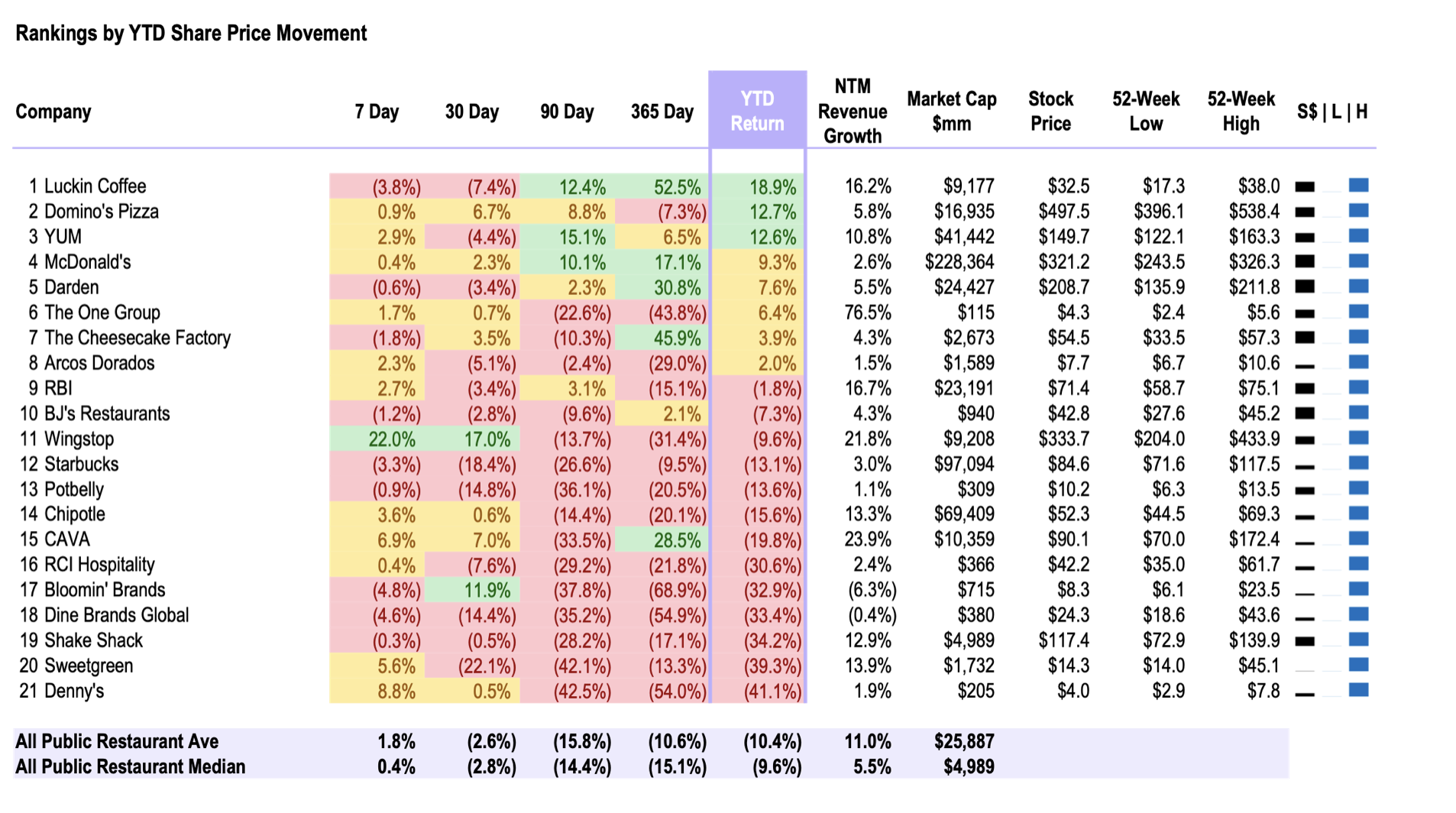

Public Market Summary for YTD Returns

Our Top Article Choices

- NRA: Economic Indicators – Same-store sales and customer traffic – Link

- 8 restaurant trends to watch in 2025 – Link

- Chipotle’s Comparable Sales Dropped Year Over Year… – Link

- Toast Data: Reservation trends shift to slower days and early dinners – Link

- WSJ – Are value meals worth it for restaurants? – Link

Deal Making: Transaction Activity

M&A in 2024 Q4 – 2025 Q1

- DoorDash Expands with Deliveroo and SevenRooms Acquisitions – Link

- Deliveroo – Deal Value: $3.9 billion

- Details: DoorDash announced its acquisition of U.K.-based food delivery service Deliveroo,

enhancing its international presence.

- Details: DoorDash announced its acquisition of U.K.-based food delivery service Deliveroo,

- SevenRooms – Deal Value: $1.2 billion

- Deliveroo – Deal Value: $3.9 billion

- Wonder to acquire Grubhub for $650m – Link

- TGI Fridays Sells Corporate-Owned Locations Amid Bankruptcy – Link

- TGI Fridays received court approval to sell nine of its 39 corporate-owned locations to

Mexico-based

MERA for $34.5 million, as part of its bankruptcy proceedings.

- TGI Fridays received court approval to sell nine of its 39 corporate-owned locations to

- Jersey Mike’s has agreed to sell a majority stake to Blackstone – Link

- Bojangles Explores Potential $1.5B Sale – Link

- Pappas Restaurants Acquires On The Border Out of Bankruptcy- Link

- Dine Brands Global Acquires 59 Applebee’s and 10 IHOP Locations- Link

- Apollo Global Management and Irth Capital have proposed to take Papa John’s private in a deal valued at approximately $2 billion – Link

Market Update: Public Comps

Week Ending | 15/08/2025

Top 10 Monthly Price Movements

The last 30-day performance had an average of 1.9% for the Top 10.

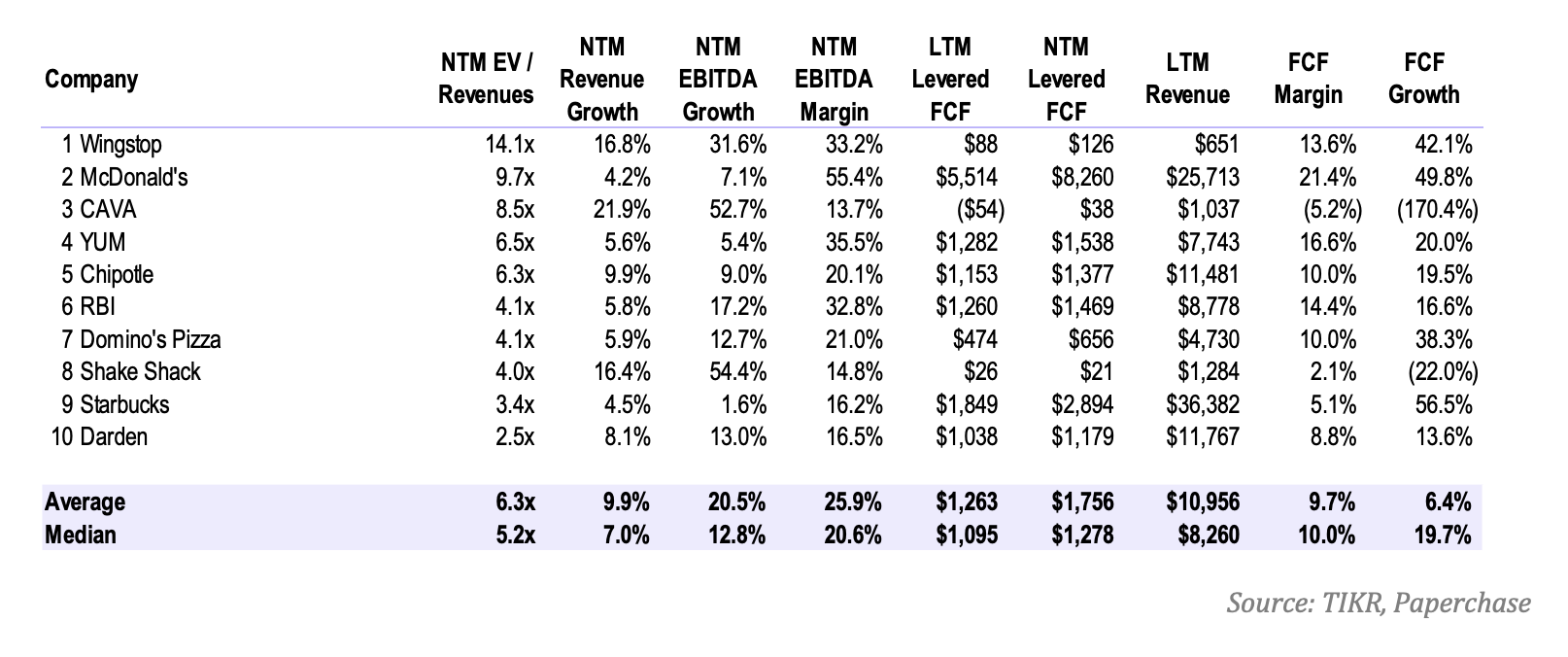

Top 10 Enterprise Value [EV] / NTM Revenue Multiples

The top 10 is made up of mostly Franchisor entities, which have higher multiples than company owned concepts. Consensus revenue growth forecasts estimate ~12.5% growth into 2025. The growth guidance is attributable to store growth and price increases.

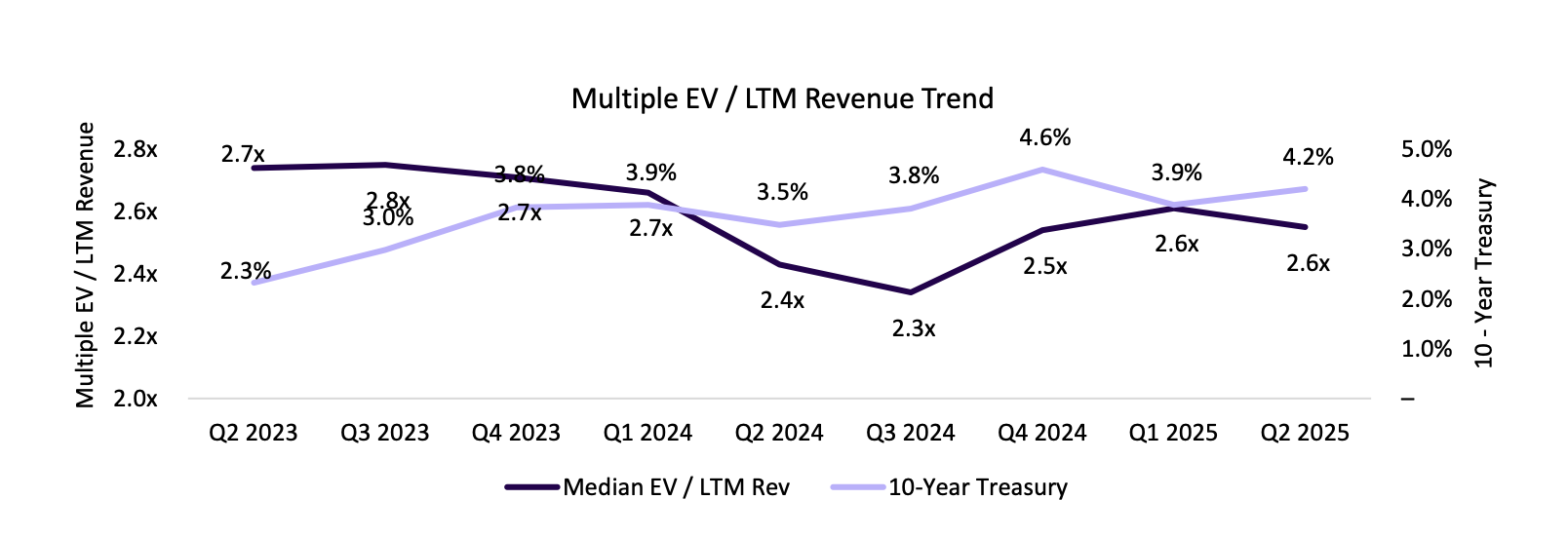

Public Comps – Trends

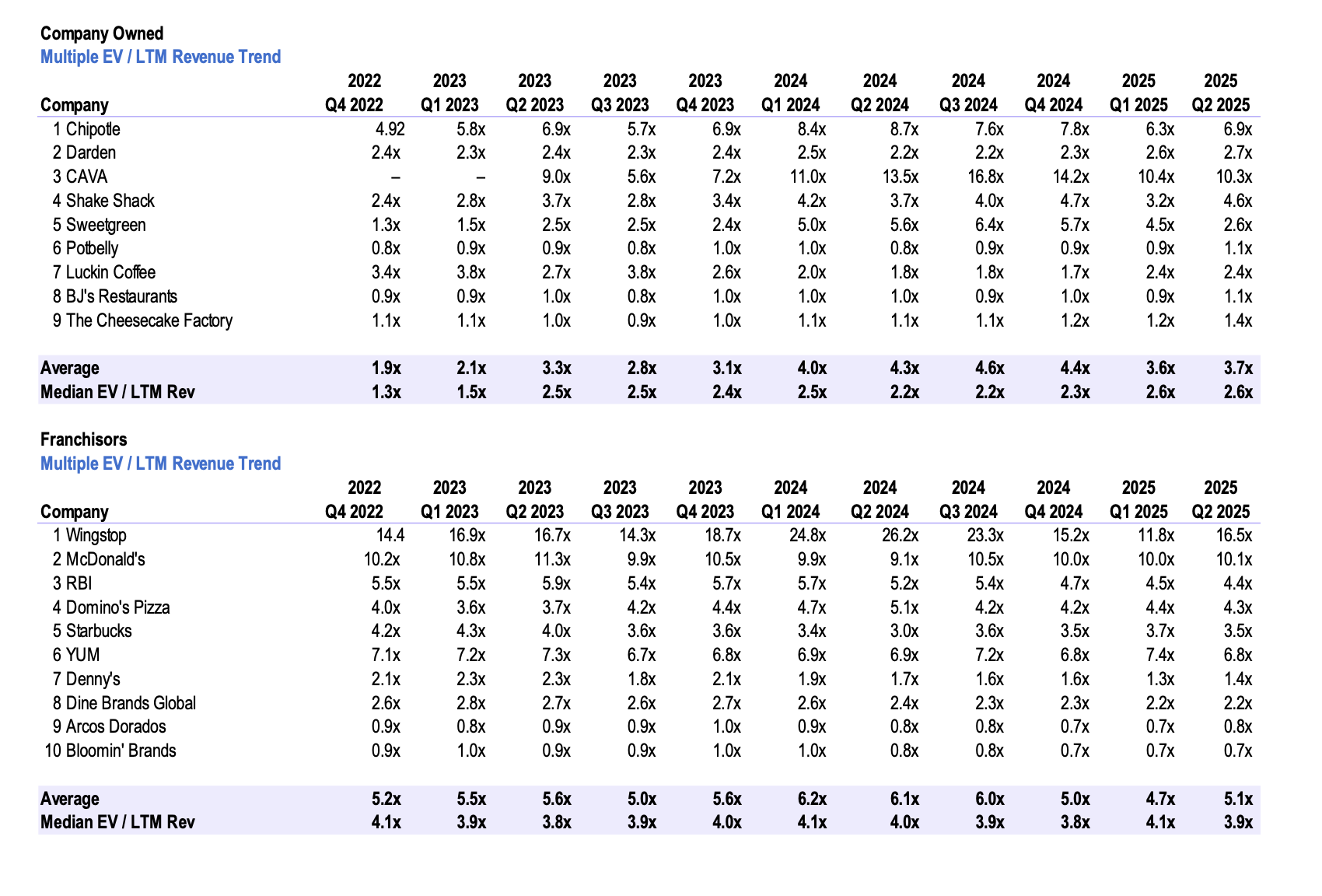

Trend – Enterprise Value [EV] / LTM Revenue Multiples

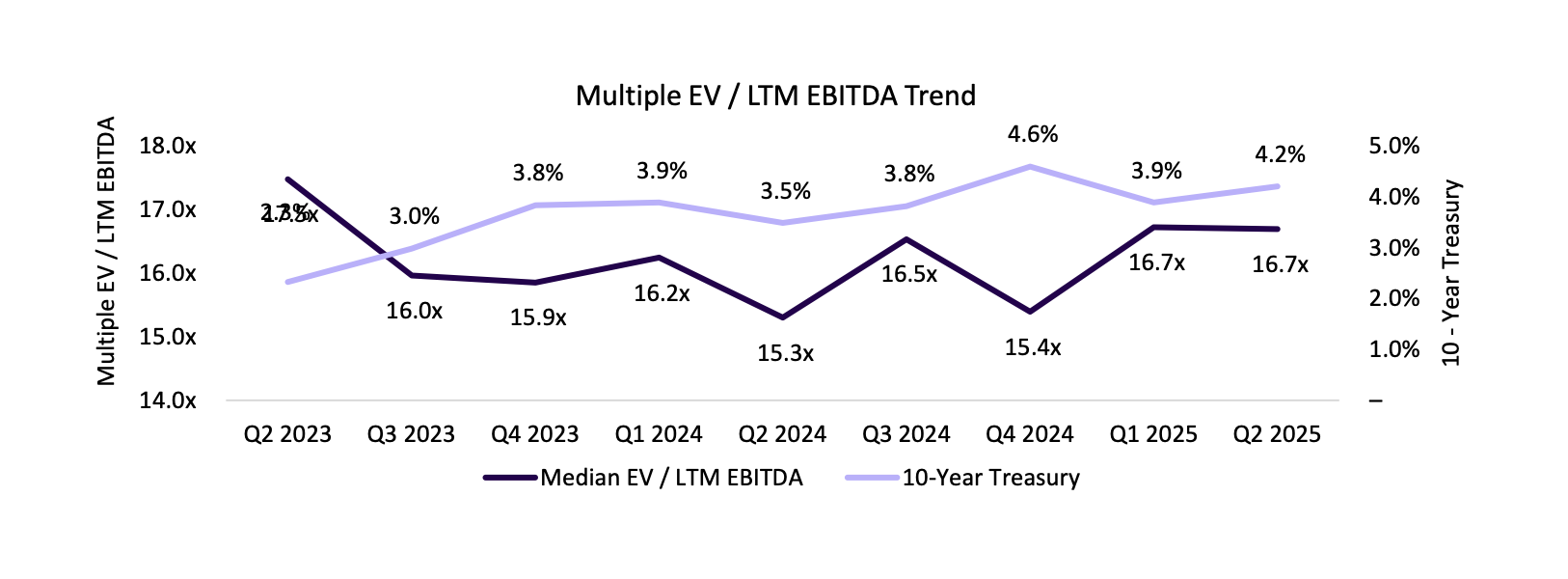

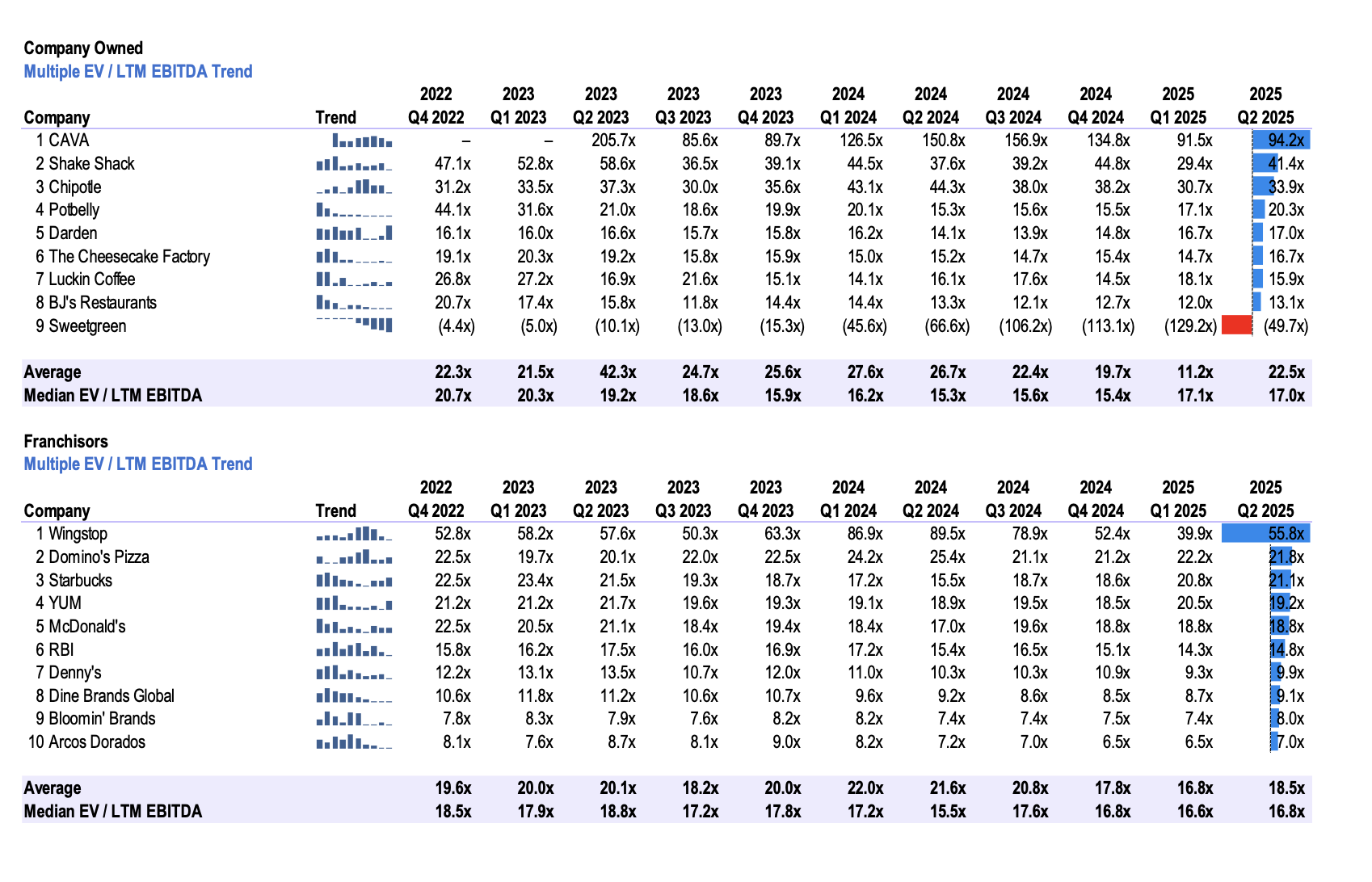

Trend – Enterprise Value [EV] / LTM EBITDA Multiples

Revenue Multiple Trends

Restaurant businesses are generally valued on multiples of their revenue or EBITDA, depending on their capital structure, growth potential, and franchise model. For example, a McDonald’s franchise has a higher revenue multiple than a company-owned restaurant chain like Shake Shack.

Here are some of the factors that affect restaurant valuation multiples:

- Capital structure: Businesses with less debt and more equity tend to have higher valuation multiples.

- Growth potential: Businesses with high growth potential tend to have higher valuation multiples.

- Franchise model: Franchise businesses tend to have higher valuation multiples than company-owned businesses.

EBITDA Multiple Trends

Sources

TIKR

Bloomberg

Company 10-Q and 10-K Filings

Restaurant Business

Bureau of Labor Statistics (BLS) [bls.gov] U.S. Bureau of Economic Analysis (BEA) [bea.gov] U.S. Department of Agriculture (USDA) Economic Research Service [ers.usda.gov] Federal Reserve Economic Data (FRED) [fred.stlouisfed.org] National Restaurant Association [restaurant.org] International Monetary Fund (IMF) [imf.org]

Disclaimer

The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, timeliness, or completeness of this information. The author and all employers and their affiliated people assume no liability for this information and no obligation to update the information or analysis contained herein in the future.