In times of economic uncertainty, the hospitality industry is affected by equity-market downturns that can create revenue-crushing reactions – hurting both consumers and operators alike. Looking back at the most recent recession, dining out dropped 8.8% in December 2007–June 2009, relative to pre-recession period levels. The severe, sustained market crashes coincided with marked contractions in restaurant expenditures throughout the two-year recession NBER.

Currently, the economy is showing a familiar pattern. President Trump’s announcement of international tariffs in April 2025 sent an already unstable market falling. This economic downturn has led to reduced consumer spending and uncertainty over the economic future with many restauranteurs seeking to understand the impact of these fluctuations on their revenue. Paperchase’s financial specialists in the restaurant and bar industry analyzed same store data across all restaurant sectors to detail the correlation between equity-market crashes and the food and beverage business.

2023 Market Correction vs 2025 Market Drop

Although the tariffs are not expected to directly impact restaurant costs as much as other sectors, the runoff effects of the downturn have affected the revenue of hospitality businesses across the industry.

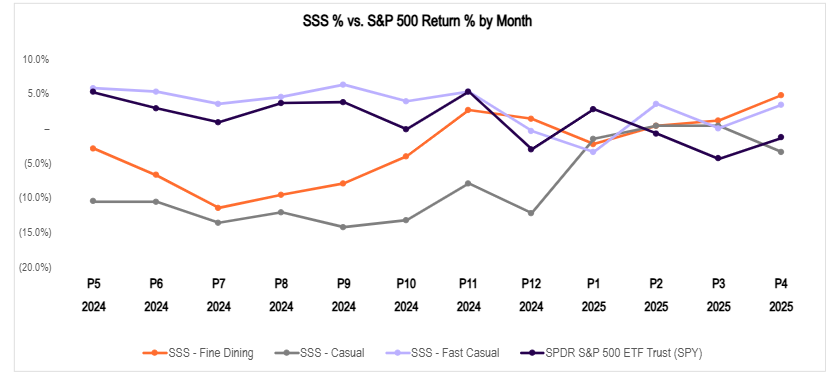

In reaction to the tariff announcement, the Dow Jones Industrial Average dropped over 4,000 points over two days in April 2025, marking a 9.48% decline. The S&P 500 and Nasdaq experienced composite declines with a combined 11% loss. Paperchase’s team compared data from the April 2025 crash to the 2023 Market Correction, identifying a historic correlation on hospitality revenue in times of economic crisis.

Between July 31st and October 27th, 2023, the stock index fell from 4,588 to 4,117, a -10.3% decline over 88 trading days. Similarly in 2025, from February 19th to March 13th the stock index retraced −10.0% from its February high, entering correction territory as of March 13, 2025. This adjustment came in just a few weeks before the crash on April 3rd, resulting in the S&P 500 dropping 275 points, or −4.85%, to 5,395.

Source: Paperchase

US Markets

The stock market fluctuates on a regular basis, but major economic developments can send it spiraling. Paperchase reviewed previous economic slowdowns in addition to this most recent stock market downturn to identify the historic and recent effects of the trading economy on revenues across segments including Fast Casual, Contemporary Casual, and Fine Dining.

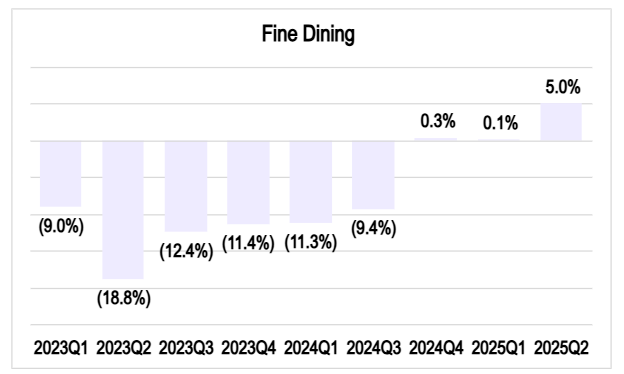

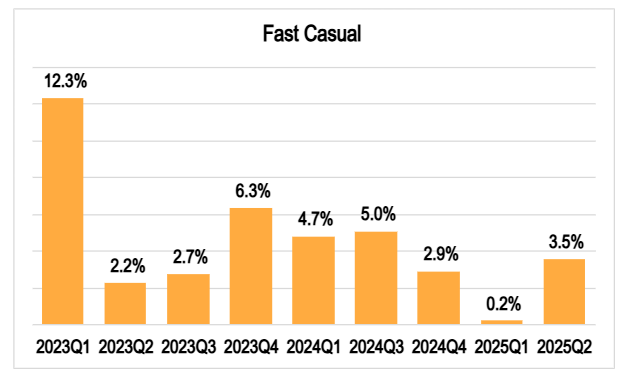

2025 Market Drop

After the tariffs were announced, fast-casual and quick-service restaurants saw their sales increase by about 2.7% on average in February and March compared to 2024. Mirroring the trend from economic downturns in previous years, higher-end restaurants held up better than in prior economic downturns. While the impact of the downturn on restaurant revenue can be seen as minimal, there was a decrease in traffic across all segments. This drop in traffic is likely due to the ongoing uncertainty about trade policies and the impact of the new tariffs. In 2025, overall revenue remains stable despite a decline in customer traffic. This equilibrium has been maintained by an increase in average transaction value and menu pricing. While revenue reporting was consistent with the prior period, the volume of individual transactions decreased. Notably, Fine Dining establishments experienced stagnant sales rates.

In a survey on consumer sentiment by the University of Michigan, 60% of respondents mentioned tariffs unprompted, reflecting broad worries that tariff spikes will keep prices elevated and disrupt supply chains. The survey, which compared March and April 2025 to March 2024, showed a –32.4% drop in consumer sentiment over the last year.

Same Store Sales Across Segments

Source: Paperchase

Source: Paperchase

Source: Paperchase

News from Reuters echoed these feelings, with consumers saying for the fourth month in a row that they were worried about how the tariffs would hurt the economy. In the same survey, respondents also pointed to rising prices as another reason they had less money to spend. The survey concluded that many consumers expected inflation to get worse over the next year, increasing from a 5.0% expectation to 6.5%. This was linked to a negative outlook on the possibility of wage increases in 2025. Overall, people have significantly cut back on spending in pretty much every part of the economy.

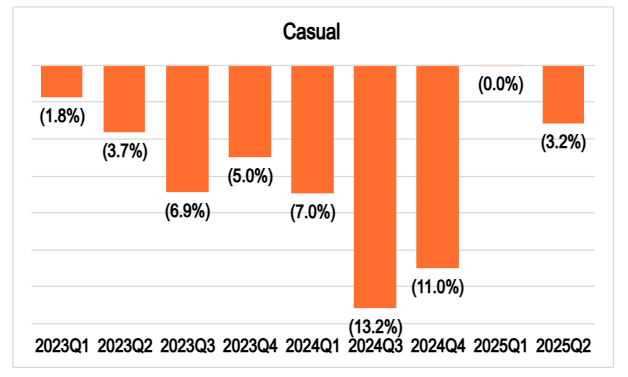

The 2023 Correction

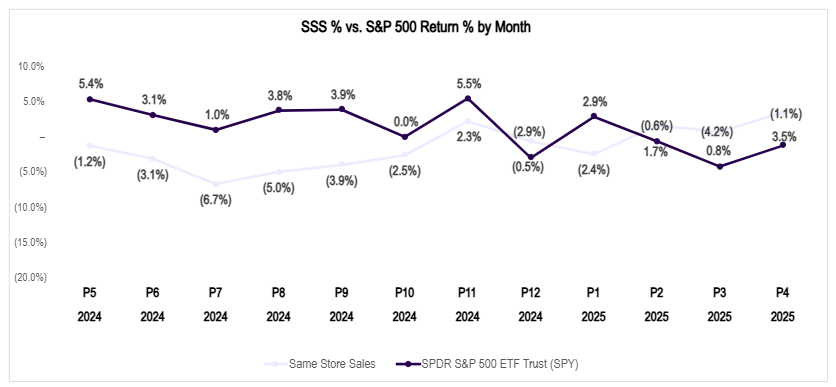

The S&P 500 dropped by about 10% between late summer and early fall of 2023, contributing to a significant slowdown in consumer spending across all types of businesses. Economic uncertainty continued to be felt with restaurant revenue falling through summer 2024. Hits on the stock market can result in consumer backlash and decreased spending, representing a clear link between what’s happening in the stock market and how restaurants and bars are performing. Paperchase’s analysis of sales at the same stores during the first half of 2024 reflects this trend.

Comparing winter 2024 to summer 2024, Paperchase’s group of Fine Dining and Casual Dining businesses saw major declines of about 8.0% and 11.9%. In contrast, the Fast Casual segment experienced growth of around 4.4% during this period, signaling a customer push towards affordable options. This data lines up with trends we’ve seen since the pandemic. For the past two years, Fast Casual has been the strongest performing category in our cohort, mirroring public market data for fast-casual businesses.

UK Markets

When President Donald Trump announced tariffs in April 2025, it had a knockdown effect on global economies. Many of Paperchase’s customers in the UK saw fluctuation in an economy that has been shrinking for four quarters in a row. Our experts compared information from both 2023 and 2025 to see how the UK restaurant market tends to react when the international economy is under pressure.

2025 Stock Market Decline

Between February 19th and March 13th, 2025, the 10% drop in the stock market signaled that respondents in the UK were becoming more cautious about spending in restaurants. Unlike the market adjustment in 2023, Fine Dining saw the most significant decrease this time, while Fast Casual performed better than other segments.

Sales at the same Fine Dining locations fell by 4.7%, while Casual Dining showed a steady but small growth of 0.1%. In contrast, Paperchase’s Fast Casual clients in the UK did much better than expected, with a strong growth of 13.6%. This was likely driven by rapid improvements in technology such as online ordering as customers favor good value and convivence post-pandemic.

2023 Market Adjustment

While the UK market didn’t see as dramatic a downturn in 2023 as other regions, there was still enough of an impact to cause sales to decrease across different types of restaurants. When we looked at our Paperchase UK customers in early 2024, the average sales decreased slightly by 0.1% compared to the year before. Fine Dining and Fast Casual both saw drops of around 2.5-2.6%, while Casual Dining restaurants experienced a modest increase of 2.4%.

During times of economic uncertainty, consumers in the UK are historically keen on affordable options that still offer good value. The “Casual” category, which includes cafes and pubs with lower average spending, saw their sales growth at the same stores fall to single digits in early 2024. Fine Dining in major cities like London has historically remained relatively stable, even when there’s global economic pressure.

Consumer Sentiments

Sudden equity-market downturns coincide significantly with decreases in restaurant traffic and spending. Some of the immediate effects include a rising sensitivity to dining out in conjunction with these market swings. An economy in flux fosters fear among consumers and economic uncertainty siphons revenue from restaurants already holding on by a thread in a competitive market.

Spending responsiveness has also given rise to higher credit card debt among consumers. According to a report by ABC, American household debt (credit cards, loans, and mortgages), hit a record high of $18.04 trillion in February 2025. With this rise, delinquencies such as missed payments also increased – contributing to less spending overall. This reactionary approach to the economy is tied to Renaissance Macro Research report that showed restaurant and bar sales decreasing by 1.54% in February 2025 – right around the release of the household debt report. This market volatility rippled through SSS to contribute to a three-month decline of 8.5%. The correlation between rising debt and equity-market downturns is telling, specifically, of dwindling consumer confidence in the market.

General Outlook

Despite some segments thriving over others during this period, the outlook of the food and beverage industry remains unclear. Paperchase’s restaurant finance analysts predict flat forecasts moving forward until the market corrects itself. To combat this, operators have shifted their focus to customer retention and high value offerings. This includes decreasing menu prices through discounts and loyalty program offerings. Overall, the industry has adopted a keen focus on technology, especially fostered by an increase in online ordering from younger generations.

Outside of direct influences on the industry, capital spending has been affected by the 2025 tariffs. Restaurant owners have seen price increases on goods like equipment, construction, and beverage vendors. This has added strain and contributed to fluctuations in revenue felt by business operators.

Overall Economic Forecast

The data compiled and analyzed by Paperchase’s hospitality finance teams paints a clear picture of the sensitive relationship between equity market downturns and the food and beverage industry. The recent market volatility in early April 2025, triggered by global tariffs, echoes historical trends, albeit with nuanced segment-specific impacts. While the 2023 market correction saw a broad slowdown across all restaurant types in both the US and the UK, the 2025 drop revealed a more pronounced shift towards value-driven options. Fast casual and QSR segments demonstrated greater resilience, even growth in the UK, while fine dining experienced more significant declines.

The overall takeaway shows the profound influence of consumer sentiment and spending power, both directly affected by market fluctuations and macroeconomic factors like tariffs and rising household debt. The near quadrupling of spending responsiveness to stock market changes over the past two decades highlights the increased sensitivity of consumers to economic uncertainty. The added burden of increased capital spending due to tariffs further complicates the industry’s outlook, suggesting a period of flat growth until market stability returns. These findings emphasize the need for hospitality businesses to remain agile and adapt their strategies in response to the ever-evolving economic landscape and its direct impact on consumer behavior.